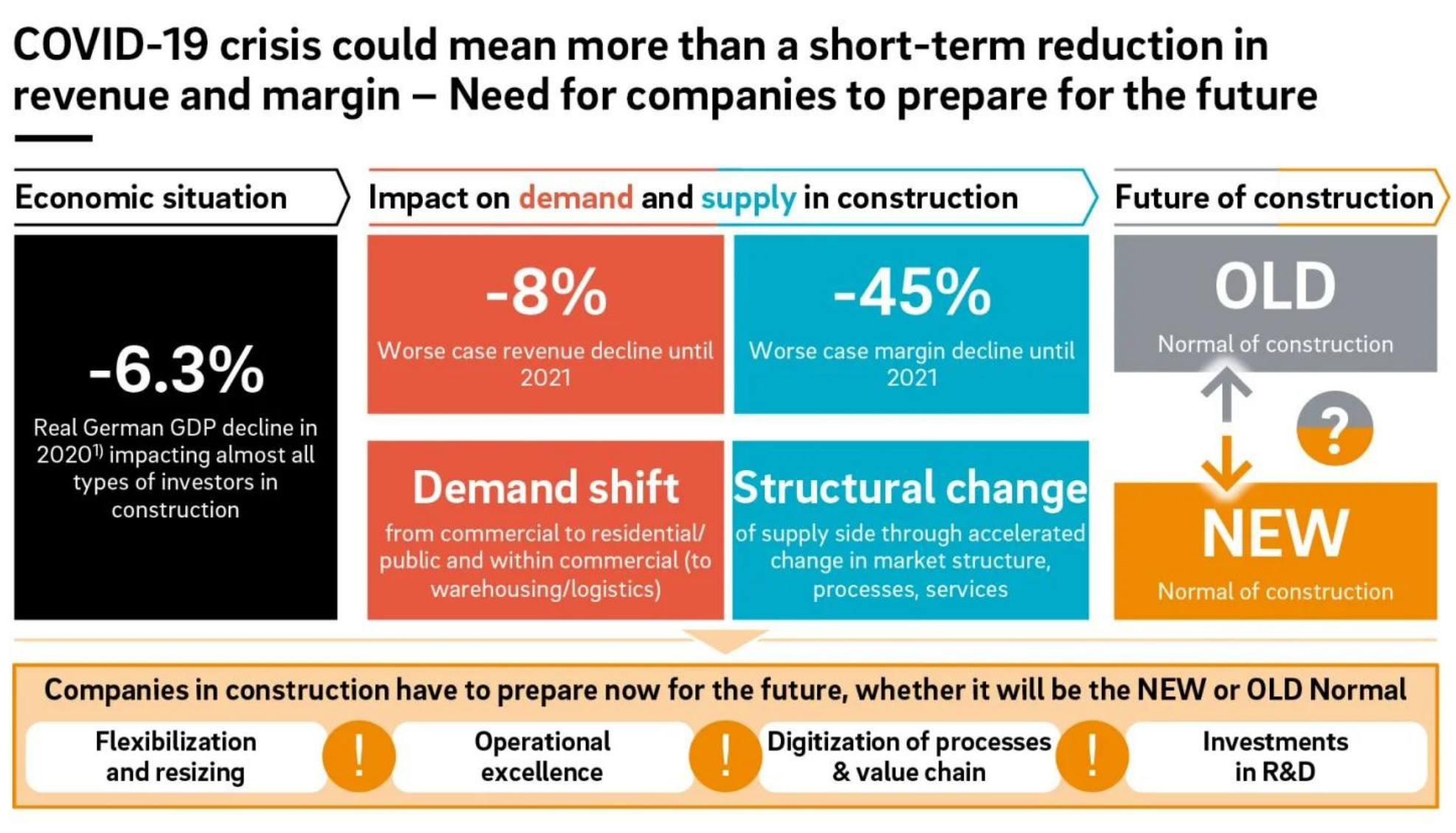

The impact of Coronavirus on the Indian real estate market was so severe that property transactions came to a standstill when the country went into total lockdown during both waves. Since then, the market has made a number of steps toward recovery.

The real estate industry in India experienced significant setbacks during the 1st, 2nd and 3rd waves of the COVID-19 pandemic, but it is currently showing signs of gradual recovery. Experts predicted that the market will fully recover in 2021, since enquiries, site visits, and sales had begun to approach pre-COVID levels in most cities. The With the coming of a new variant/strain of COVID-19 in a more fatal form by April 2022, on the other hand, caused significantly greater concern than 2020. With numerous cities, including Mumbai, Pune, and Delhi NCR, experiencing partial lockdowns and people trying to get healthcare, the real estate market had taken another hit…

The magnitude of the influence

The extraordinary scope of COVID-19’s impact on Indian real estate may be gauged by the sector’s loss of over Rs 1 lakh crore since the pandemic broke out (Source: KPMG). The pandemic, according to the research, resulted in a severe financial constraint for real estate developers. The loan crunch reduced residential sales in India’s top seven cities from four lakh units in 2019-20 to 2.8 lakh units in 2020-21. At the end of FY-21, the outstanding loan portfolio of home loans in India stood at a whopping ₹22.4 lakh crore, growing 12.1% since its size in FY-20. Also, between FY-17 and FY-21, the Indian home loan market grew by 32% CAGR.

According to a survey by India Ratings (Ind-Ra), total residential demand fell by more than 40% in the first half of FY22. The agency expects that sales will be limited until the COVID-19 problem is adequately addressed. However, between January and June 2021, new project launches in India surged by 71%. (Image courtesy of Knight Frank.) Stamp duty reductions in several states can be attributable to the increase in new launches. Because of the restricted mobility and cautious buyer mentality, there was an unusual surge in unsold inventories as well. According to a Liases Foras assessment, the COVID-19-led shutdown increased unsold inventories from more than 15 quarters at the end of FY-20 to more than 19 quarters towards the end of FY-20.

COVID-19’s Impact on Commercial and Retail Real Estate

In addition to having a negative impact on residential sales, the work-from-home idea has also had a negative impact on the growth of office space leasing organisations. According to a Cushman and Wakefield research, net leasing of office premises fell to roughly 35 lakh sq ft in January-March 2021, down from around 70 lakh sq ft in the same period in 2020. Starting Q4 of 2022, the financial year ended on a promising note with the Government’s immunisation programme picking up pace, the abrupt surge in cases throughout the country since February onwards did not speak well for the recovery cycle, and occupiers remained wary in the Apr-Jun 2022 quarter. As a result, possible lease contracts were further postponed. The COVID-19 pandemic has got e-retail quickly progressing from being a regular habit for a minority of consumers to becoming a new norm of shopping behaviour. The quarterly growth in retail space was up by 79% from Q2 2020– Q3 2020.

Already, net lease rates have fallen by 33% in the last year, and typical commercial property values have fallen by 7-10%. In 2021, Blackstone Group, one of India’s leading office space owners, claimed that the COVID-19 pandemic has pushed back project completion schedules, lowered demand, and softened rental rates. The demand for flexible workplaces, which had risen in the last two years, has also fallen yet again. If the market recovers quickly, analysts predict that 38 million square feet of flexible workspace will be leased in the year 2022. According to CBRE’s Occupiers’ Survey, the use of technology and innovative business processes has revived investors’ interest in the commercial real estate industry.

Consumers are apprehensive about going to malls and stores, therefore the retail sector has taken a beating in the second phase. According to Statista statistics, retail mobility in India has decreased by 55-60% as a result of partial lockdowns and curfews across cities. However, thanks to the optimism provided by the mass vaccination effort, the retail sector has seen a remarkable rebound, returning to 72 percent of pre-pandemic levels in July 2022.

The effect of COVID-19 on property values

So far, the impact of the pandemic’s second wave has not resulted in a price change in the home market. Developers continue to hold back pricing owing to slim profit margins, as they did last year. While liquidity limitations may decrease prices in the long run, any short-term impact is quite improbable.

The real estate developer community is cautiously optimistic, but cautious Since the Coronavirus-induced lockdown has now been lifted in most of the states in India and also in many countries across the globe, the real estate market has been gradually recovering. The second wave of COVID-19 had a minor impact on the business since, following the first lockdown stage in April 2020, individuals realised the importance of house ownership. The new variants or Covid-19 waves will not result in a significant decline in real estate values, but there will be some domino repercussions. Not directly as a result of COVID-19, but as a result of the linked restrictions put on the public’s movements and delayed help on other support services, such as processing documents for house loans, registering sale deeds, or reaching out to sales representatives. Despite a positive hope due to the vaccination drive, the year 2023 is expected to remain challenging for the real estate sector, if not a complete washout.

NRIs are investing in real estate.

Rental profits have been the key reason for Non-Resident Indians (NRIs) to invest in real estate in India. However, the global uncertainty caused by the pandemic has prompted the NRI population to purchase a house in India as well. With deposit rates in the 6-7 percent level and the rupee’s value decreasing against the US dollar, NRIs are actively exploring investment possibilities in the Indian real estate sector. Because of the pandemic, the usage of virtual visits has increased, allowing the NRI community to browse, choose, and invest in real estate online.

According to reputable research studies, NRI investment in Indian real estate is expected to reach $13.3 billion in fiscal year 2021. This is more than a 6% increase over the previous year. However, in the aftermath of the second wave, a part of the NRI community has begun selling previously held homes due to the second wave and the resulting dread of uncertainty. This may not be considered a pan-India trend because NRIs who have invested in Pune, Mumbai, and Bangalore have opted to remain invested. Indeed, Bangalore has emerged as the preferred place for NRI investment. Furthermore, NRI investment in India’s real estate industry is estimated to surpass $15 billion in fiscal year 23.

Conclusion

Overall, the real estate business is not immune to difficulties. Whether it was the 2008 downturn or the infamous Non-Banking Finance Companies (NBFCs) crisis, the real estate sector met the problems straight on. The recovery is certain, but the second wave has delayed the pace. Furthermore, with the changing norms and new variants, there may be certain obstructions and hurdles for the sector to overcome. However, much depends on the speed with which the immunisation campaign is implemented and the actions taken by the government to stimulate the real estate recovery.

Sources:

- Impact of coronavirus (Omicron) on Indian real estate

- Impact of Coronavirus on Indian real estate

- Commercial real estate must do more than merely adapt to coronavirus

- Investing in the net-zero transition

- Impact of COVID-19 on Real Estate Industry in India

Disclaimer: The information contained herein have been compiled or arrived at, based upon information obtained in good faith from sources believed to be reliable. The opinions expressed within the content are solely the author’s and can be subject to change. The image featured in this article is only for illustration purposes. If you wish the article to be removed or edited, please send an email to editor@biltrax.com